In the dynamic landscape of software-as-a-service (SaaS) businesses, accurate revenue prediction is the linchpin for sustainable expansion. Founders and finance leaders often grapple with volatile subscription models, where customer churn and expansion can dramatically alter financial trajectories. A SaaS revenue forecasting template emerges as an indispensable tool, offering a structured framework to project future income based on recurring revenue patterns. This template not only simplifies complex calculations but also aligns projections with strategic goals, helping companies navigate funding rounds, optimize resource allocation, and mitigate cash flow risks. By inputting key metrics like monthly recurring revenue (MRR) and growth rates, users can generate realistic scenarios that inform everything from pricing adjustments to hiring plans.

The Core Components of SaaS Revenue Forecasting

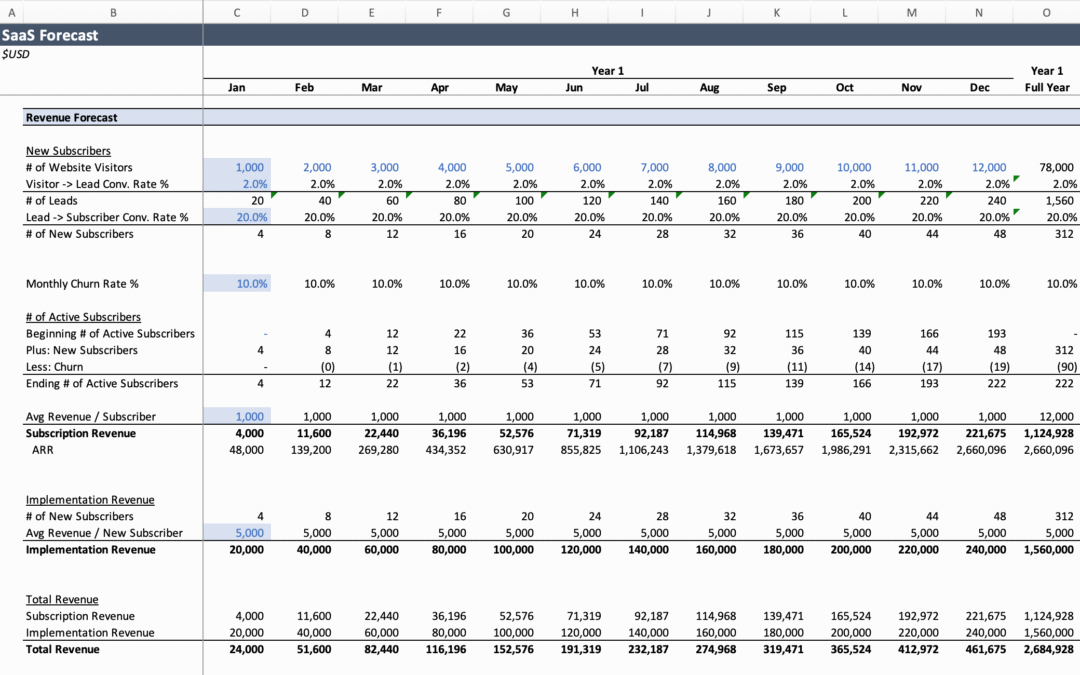

At the heart of any effective SaaS revenue forecasting template lies a deep understanding of subscription economics. Unlike one-time sales in traditional software, SaaS thrives on predictable, recurring income, making it essential to model elements such as new customer acquisitions, upgrades, and downgrades. The template typically starts with baseline MRR, which captures revenue from active subscriptions, and extends it to annual recurring revenue (ARR) for a broader view. From there, it incorporates growth drivers like customer acquisition through marketing channels, while factoring in churn—the percentage of revenue lost to cancellations.

A well-designed template breaks this down into modular sections. For instance, it might include a cohort analysis to track revenue from customer groups acquired in specific periods, revealing patterns in retention over time. Expansion revenue, from upsells or add-ons, adds another layer, often boosting forecasts by 10-20% in mature SaaS firms. Expenses tied to customer acquisition costs (CAC) are also woven in, ensuring projections reflect net profitability rather than gross optimism. This holistic approach prevents common oversights, such as assuming linear growth without accounting for seasonal dips in sign-ups during holidays or economic slowdowns.

Customization is a hallmark of these templates, allowing adaptation to B2B or B2C models. Enterprise-focused SaaS might emphasize long-term contracts with lower churn, while consumer apps prioritize viral coefficients for rapid scaling. By automating formulas in tools like Excel or Google Sheets, the template reduces manual errors, enabling quick iterations as market conditions evolve. Ultimately, this foundation empowers teams to shift from reactive budgeting to proactive planning, turning data into a competitive edge.

Integrating Key Metrics for Accurate Projections

Precision in SaaS revenue forecasting hinges on leveraging industry-standard metrics within the template. Net revenue retention (NRR), which measures how much revenue is retained and expanded from existing customers, is a critical input—aim for over 100% to signal healthy growth. The template calculates this by dividing current-period revenue from a cohort by its initial revenue, highlighting the impact of pricing tiers or feature enhancements.

Churn forecasting deserves special attention, as even a 5% monthly rate can erode millions in potential ARR over years. Templates often use historical data to predict churn probabilities, segmented by customer type, such as small businesses versus enterprises. Pairing this with lifetime value (LTV)—computed as average revenue per user divided by churn—provides a ratio against CAC that guides marketing spend. A 3:1 LTV-to-CAC ratio is a benchmark for efficiency, and the template can simulate adjustments, like reducing churn through better onboarding, to see uplift in forecasts.

Growth assumptions round out the metrics, drawing from pipeline data in CRM systems. Templates incorporate win rates for leads, conversion timelines, and expansion opportunities, creating multi-year projections. For example, a SaaS company with $500,000 MRR growing at 15% quarterly might forecast $2 million ARR in 18 months, but the template flags risks if churn spikes to 7%. This metric-driven structure ensures forecasts are grounded in reality, avoiding the pitfalls of unchecked optimism that doom many startups to cash crunches.

Practical Applications in Business Strategy

A SaaS revenue forecasting template transcends spreadsheets; it’s a strategic asset for decision-making across the organization. In fundraising preparations, it generates investor-ready projections that demonstrate scalability, such as how a 20% month-over-month MRR increase supports a $10 million valuation. Venture capitalists appreciate these templates for their transparency, often requesting them to stress-test assumptions during due diligence.

For internal operations, the tool aids in cash flow management by linking revenue forecasts to burn rates. Bootstrapped SaaS firms use it to extend runway, simulating scenarios like delaying hires if projections show a revenue dip. Pricing strategy benefits immensely—templates allow A/B testing of models, revealing whether freemium tiers drive more conversions than direct sales, ultimately optimizing ARPU.

Scaling teams also rely on it for resource planning. A forecast showing $1.5 million ARR in the next quarter might justify expanding sales headcount, while conservative estimates prompt cost controls. In mergers or acquisitions, the template provides a neutral benchmark, showcasing revenue potential to buyers. Its versatility makes it ideal for growth-stage companies transitioning from ad-hoc tracking to sophisticated financial modeling, fostering alignment between product, sales, and finance.

Addressing Challenges and Enhancing Forecast Reliability

Despite their power, SaaS revenue forecasts face hurdles like data silos or external shocks, such as regulatory changes in data privacy affecting user sign-ups. A robust template counters this with sensitivity analysis, varying inputs like growth rates by ±10% to produce best-case, base, and worst-case scenarios. This range helps build resilience, preparing leaders for volatility without paralyzing action.

Another challenge is over-reliance on historical data, which may not capture emerging trends like AI integrations boosting retention. Advanced templates incorporate forward-looking adjustments, such as market expansion factors, to keep projections fresh. Regular updates—quarterly at minimum—ensure accuracy, with dashboards visualizing trends for non-technical stakeholders.

For smaller teams lacking dedicated finance roles, user-friendly templates lower the barrier, often including tutorials for inputting data from tools like Stripe or HubSpot. This democratization accelerates adoption, turning forecasting from a chore into a routine that drives agility. By highlighting gaps, such as high CAC in certain channels, the template guides optimizations that compound revenue over time.

Looking Ahead: Elevating SaaS Success Through Forecasting

As SaaS ecosystems evolve with global reach and hybrid models, revenue forecasting templates will integrate AI for predictive analytics, anticipating churn from user behavior data. Today, they already equip founders to scale with confidence, transforming uncertainty into opportunity. Whether refining go-to-market strategies or securing capital, a SaaS revenue forecasting template is the compass for navigating growth’s complexities.

In a sector where 82% of failures stem from financial mismanagement, this tool stands as a safeguard, enabling data-informed pivots that sustain momentum. For SaaS leaders seeking an edge, embracing such templates isn’t optional—it’s the pathway to enduring profitability and market leadership.